mississippi state income tax brackets

Prior to 2022 the Pelican States top rate ranked 25th. This means that these brackets applied to all income earned in.

Top Income Tax Rate By State States With No Income Tax 1 Alaska 2 Florida 3 Nevada 4 South Dakota 5 T Retirement Retirement Income Retirement Locations

Explore state individual income tax rates and brackets for 2021.

. Overall state tax rates range from 0 to more than 13 as of 2021. 0 on the first 2000 of taxable income 3 on the next3000 of taxable income 4 on the next 5000 of taxable income 5 on all taxable income over. As you can see your income in Mississippi is taxed at different rates within the given tax brackets.

The following three years the 5 bracket will be reduced to 4. Mississippi Income Taxes. Box 23058 Jackson MS 39225-3058.

The following three years the 5 bracket will be reduced to 4. As of January 1 2022 Mississippi has. 3 rows Mississippi state income tax rate table for the 2022 - 2023 filing season has three income.

You will pay 0 of Mississippi state taxes on your pre-tax income of 40000. Because the income threshold for the top. If you are receiving a refund PO.

California Hawaii New York New Jersey and Oregon have some of the highest state income tax rates in. After the first year the tax-free income levels will be 18300 for a single person and 36600 for a married couple. All other income tax returns P.

The income tax in the Magnolia State is based on four tax brackets with rates of 0 3 4 and 5. The graduated income tax rate is. 4 rows The Mississippi income tax has three tax brackets with a maximum marginal income tax.

Any income over 10000 would be taxes at the highest rate of 5. Mississippi State Single Filer Tax Rates Thresholds and Settings. Mississippi also has a 400 to 500 percent corporate income tax rate.

The state income tax rate in Mississippi is progressive and ranges from 0 to 5 while federal income tax rates range from 10 to 37 depending on your income. After the first year the tax-free income levels will be 18300 for a single person and 36600 for a married couple. In the following three years the 5 bracket will be reduced to 4.

Starting in 2023 the four percent income tax bracket will be eliminated. Tax Bracket Tax Rate. Mississippi has a 700 percent state sales tax rate a max local sales tax rate of 100 percent and an average.

For single taxpayers your gross income must be more than 8300 plus 1500 for each dependent. Because of tax cuts approved years ago the tax. Box 23050 Jackson MS 39225-3050.

3 rows Mississippis income tax brackets were last changed four years prior to 2020 for tax year. Under current laws a single person with no dependents in Mississippi currently pays no tax on the first 12300 of income. This means after the first year the.

If youre married filing taxes jointly theres a tax rate of 3 from 4000. In Mississippi theres a tax rate of 3 on the first 4000 to 5000 of income for single or married filing taxes separately.

Mississippi Tax Rate H R Block

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com

The 10 Best States For Retirees When It Comes To Taxes Retirement Retirement Locations Retirement Advice

State By State Guide To Taxes On Retirees Retirement Income Income Tax Tax Free States

State Corporate Income Tax Rates And Brackets Tax Foundation

Pennsylvania Is One Of The Top Ten Tax Friendly States To Retirees American History Timeline Retirement Advice Retirement

Repeal Prwora Project Social Security Tax Vs Old Age Retirement Income Wholedude Whole Planet Social Security Benefits Social Security Map

Monday Map State Local Property Tax Collections Per Capita Property Tax Teaching Government Map

This Map Shows How Taxes Differ By State Gas Tax Healthcare Costs Better Healthcare

State By State Guide To Taxes On Retirees Kiplinger Retirement Retirement Advice Tax

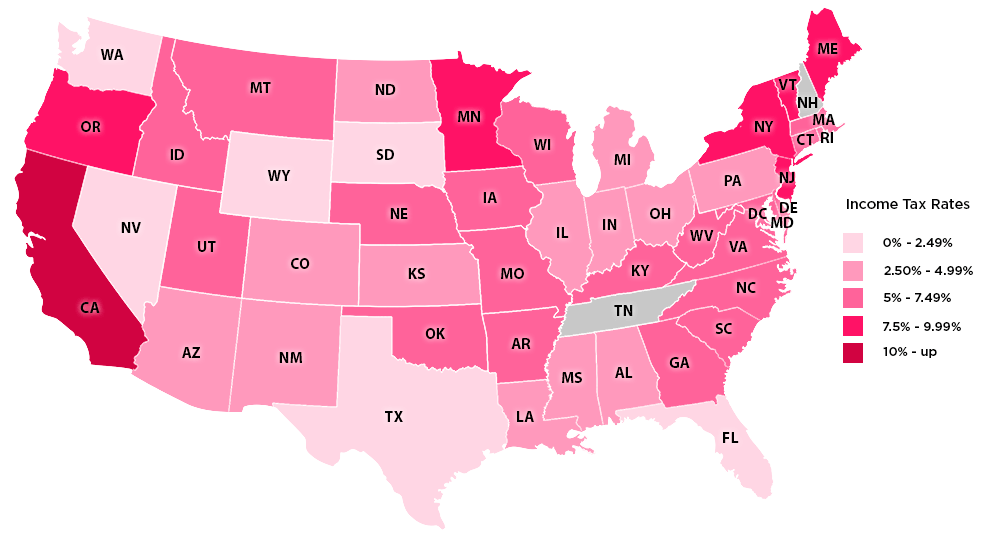

List Of States By Income Tax Rate See All 50 Of Them With Interactive Map

Which U S States Have The Lowest Income Taxes

State Income Tax Rates Highest Lowest 2021 Changes

How Do State And Local Individual Income Taxes Work Tax Policy Center

State By State Guide To Taxes On Retirees Social Security Benefits Retirement Retirement Strategies Map Diagram

37 States Don T Tax Your Social Security Benefits Make That 38 In 2022 Marketwatch Social Security Benefits Social Security State Tax

Excel Formula Income Tax Bracket Calculation Exceljet

Map State Sales Taxes And Clothing Exemptions Trip Planning Sales Tax Map