are union dues tax deductible in canada

An individual who deducted the costs of dues from their income can do so because its over the line. Do part-time employees pay reduced union dues.

Where Do I Enter My Union And Professional Dues H R Block Canada

Yearly union dues when youre a member of a.

. Are union dues tax deductible Canada. There are various types of union dues and professional membership dues you can deduct when filing your taxes. And because dues are tax deductible it works out to be much less.

At 15 per cent of total earnings MoveUPs dues are lower than most Canadian unions. Which of the following is not a common method of calculating union dues. The employee then deducted the dues if the employee was able to itemize deductions.

Are union dues tax deductible in canada. Only union membership dues are deductible and union members may not deduct initiation fees licenses. Similar to union dues you are also eligible for tax deductions on certain other items.

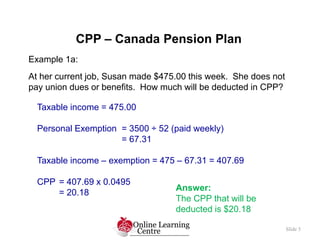

For example if your annual income is 40000 and you paid 1000 as union dues your taxable income will be only 39000. When you file your tax returns the total amount of union dues you have paid during the year will appear on your T4 and your tax software will attribute the amount to line 212 but you wont be receiving extra refund because as said before its already accounted for. If you are a member of a trade union or professional organization you can deduct certain types of union contributions or professional membership dues from your income tax applications.

Claiming a deduction for union or professional dues Between now and the end of February 2020 Canadians will receive a variety of receipts for expenditures made during the 2019 taxation year. At 15 per cent of total earnings MoveUPs dues are lower than most Canadian unions. Annual dues for membership in a trade union or an association of public servants.

Union dues and professional association fees are tax deductible. However the job-related expenses deduction is still available to people. In accordance with the relevant collective agreement the employer must deduct an amount equal to the monthly union dues from the pay of any employee in the bargaining unit.

Union dues and professional association fees are tax. For or under a superannuation fund or plan. General deductions include both mandatory deductions such as.

This should satisfy any CRA inquiries into your union dues. 2 days agoHow Much Of Your Union Dues Are Tax Deductible. However the Act provides that annual dues of a member of a trade union or association are not deductible to the extent that they are in effect levied.

Workers used to be able to deduct union dues but they could only do so if they had enough other eligible deductions that it was worthwhile to file an itemized tax return and even then the eligible. Employees have certain responsibilities in processing deductions. Some of those expenditure receipts will support a tax deduction or credit claim to be made by the recipient on his or her 2019 tax return while others will not.

Charitable donations Government of Canada Workplace Charitable Campaign parking. Do you get union dues back on taxes. You can deduct any union dues paid by you from your taxable income.

Claim the total of the following amounts related to your employment that you paid or that were paid for you and reported as income in the year. You have to keep in mind only certain types of union dues and professional membership fees you can deduct from your income tax when filingsIn a nutshell If you pay a professional membership fee you are able to deduct it. It pays to belong.

- Annual union professional or like dues. Line 21200 was line 212 before tax year 2019. In the collective agreement negotiation process the committee formed to work behind the.

Yes you can deduct the amount you pay in union dues and professional membership fees. You can claim a tax deduction for these amounts on line 21200 on your tax return. MoveUP does not issue receipts as proof of dues payment.

A percentage of gross pay a percentage of net pay a set dollar amount each pay a set monthly amount. Dues are 155 per cent of gross wages plus 2 cents per hour worked. For example suppose you earn 4000 per month have payroll deductions of 250 for health insurance 100 for 401 k contributions and 50 for union dues.

Ad get unlimited tax deduction questions answered online save time. At 15 per cent of total earnings MoveUPs dues are lower than most Canadian unions. Taxation of Union Dues.

Union dues however are after-tax deductions meaning tax is calculated and withheld on your wages first before the dues are paid. For example if you are working 40 hours a week and your weekly earnings are approximately 1000 your weekly dues are 155 per cent of 1000 which works out to be 1555 plus 2 cents per hour worked. The bill the House passed would allow union members to deduct up to 250 of dues from their tax bills.

Membership dues for trade unions or public servant associations may be deducted on income tax returns. And voluntary deductions such as. It is deductible but it has already been accounted for in your biweekly tax withholding.

August 19 2018 Taxreturncanada. Collective agreements specify that employers must deduct union dues from employees. In the bill passed by the House union members can deduct 250 dollars from their tax bill for union fees.

Please note that income tax legislation does not have any impact on the amount of union dues deducted by an employer. Professionals who are required by law to pay dues for professional boards or parity or advisory committees may also deduct those fees. No employees cant take a union dues deduction on their return.

Statistics show that union members earn an average of 54 percent more than nonunion electricians in Toronto. If youre self-employed you can deduct union dues as a business expense. Union dues and professional association fees are tax deductible.

The CRA lets you claim the following types of dues on your tax return. The amount of union fees you can claim is listed in box 44 of your T4 tickets or receipts and includes any GST HST you have paid. The deduction is above the line meaning filers can exclude the cost of dues from their.

In the case of voluntary associations dues are not deductible. You can claim dues related to your employment paid by you or paid on your behalf that were included as part of your income during the year. If the CRA asks for proof of which union your dues were paid to contact the payroll department of your employer and request a brief letter stating that they remitted the dues to MoveUP in 2013 on your behalf.

However most employees can no longer deduct union dues on their federal tax return in tax years 2018 through 2025 as a result of the Tax Cuts and Jobs Act TCJA that Congress signed into law on December 22 2017. Prior to 2018 an employee who paid union dues prior may have been able to deduct them as unreimbursed employee business expenses if the total of the dues plus certain miscellaneous itemized expenses reached a certain level. Union dues used for operations are 100 Tax deductible.

That means union members receive a 50 fold return on their union dues investment even before they take advantage of any other helpful union services. Therefore union dues may have to be adjusted retroactively.

Claiming Union Dues And Other Professional Fees

Pin On Start Your Own Business Small Business Tax Small Business Bookkeeping Business Tax Deductions

Are Our Union Dues Tax Deductible In Canada Express Digest

Canadian Tax Return Check List Via H R Block Ca Http Www Hrblock Ca Documents Tax Return Do Small Business Tax Deductions Business Tax Tax Prep Checklist

Displaying Canadian Tax Checklist Jpeg Business Tax Small Business Tax Tax Deductions

Safety Tracking Spreadsheet Spreadsheet Business Business Worksheet Business Tax Deductions

Sample Affidavit Of Financial Support Support Letter Business Letter Template Formal Business Letter